Your Salary Deserves Better (Let’s Protect It Together)

Another payday, another disappointing look at your ‘Net Pay’? You work hard—but taxes keep taking more than they should. Here’s the truth: You don’t need to be a finance expert to save tax in 2025. This guide is written like we’re chatting over coffee—no robotic jargon, just human-to-human advice to help you:

- Slash your tax bill legally (without stressful last-minute investing)

- Understand exactly where your salary goes (in simple terms)

- Make choices that grow your money (not the government’s)

Let’s start with what actually matters—your salary slip.

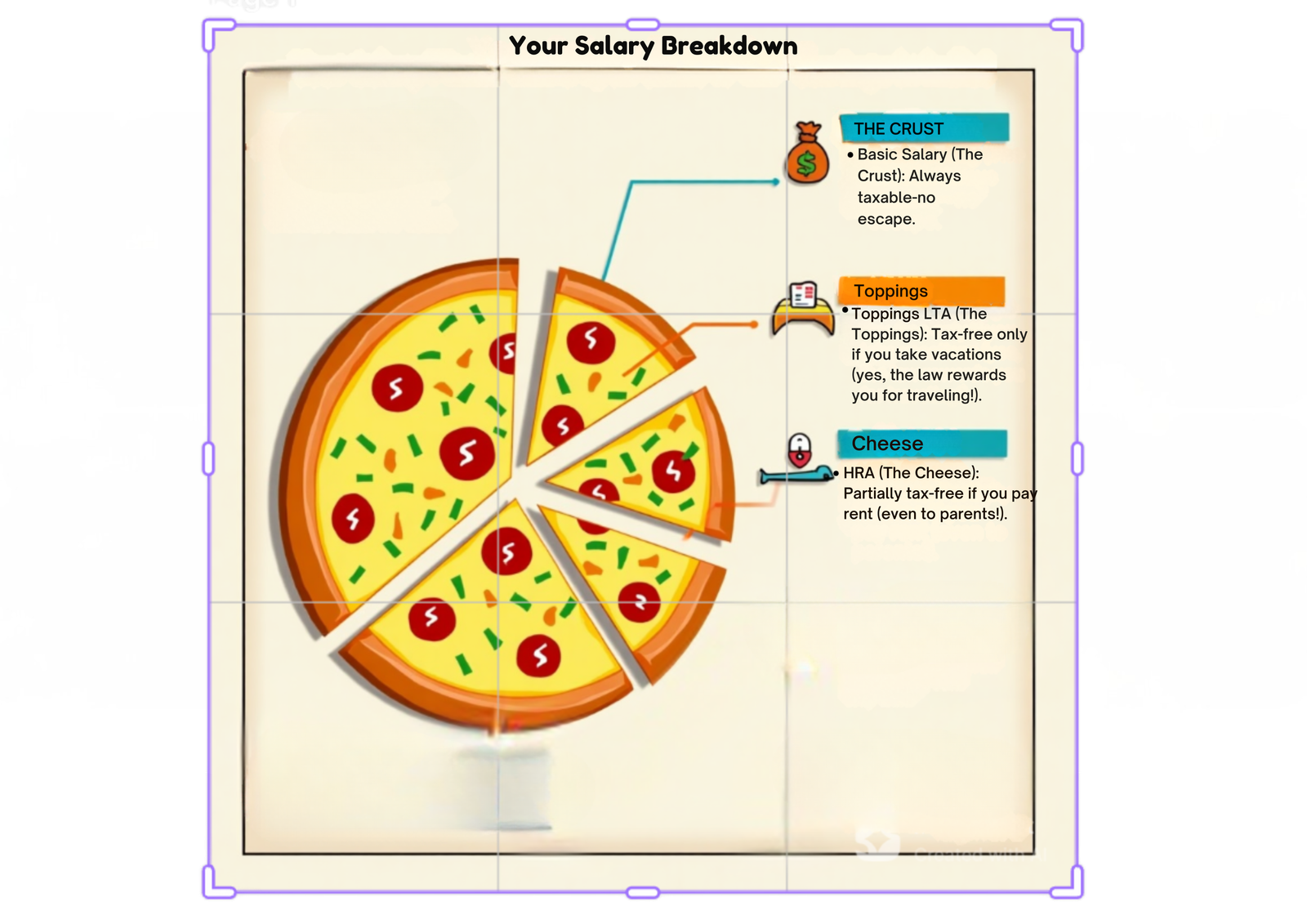

Your Salary Breakdown—Explained Like You’re 25 (Not a CA)

Imagine your salary as a pizza:

- Basic Salary (The Crust): Always taxable—no escape.

- HRA (The Cheese): Partially tax-free if you pay rent (even to parents!).

- LTA (The Toppings): Tax-free only if you take vacations (yes, the law rewards you for traveling!).

Real Talk: Most people miss HRA exemptions because HR never explains it properly. If you pay rent—even ₹10,000/month—you’re leaving tax-free money on the table.

5 Heartfelt Tax-Saving Moves for 2025 (That Don’t Feel Like a Chore)

1. Section 80C – The “I Want My ₹1.5 Lakh Back” Trick

Best for: People who hate losing money (so… everyone).

How it feels: Like getting a bonus from the tax department.

Choose investments that don’t punish you:

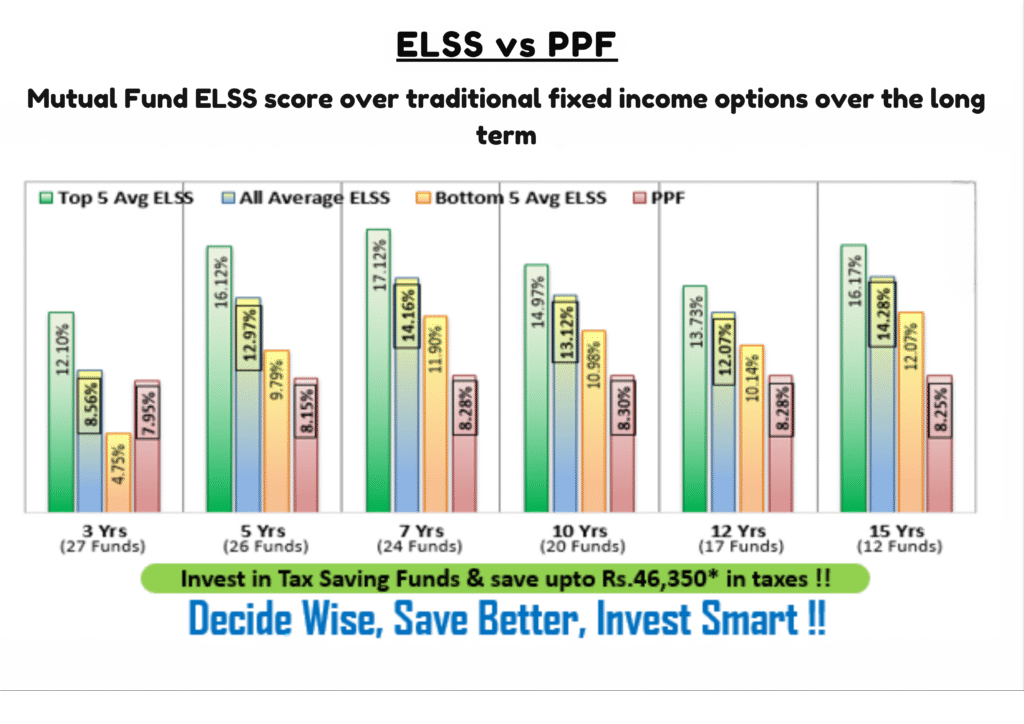

- ELSS Funds (Mutual Funds that grow and save tax) → Better than FD

- PPF (Safe, but locks money for 15 years) → Good for risk-averse folks

- Life Insurance (Term Plans Only!) → Don’t get scammed by bad policies

🚨Mistake: Waiting until March 31st to invest (panic mode!). Start a ₹5,000/month SIP in ELSS today—it’s easier than you think. Check out the Top ELSS funds for 2025.

2. Health Insurance (Section 80D) – Because Your Family’s Safety Should Save Tax Too

Best for: Anyone with parents over 60 (extra ₹50,000 deduction!).

How it feels: Like the government finally giving you a break for being responsible.

Pro Tip: If your company provides health insurance, you can still claim extra for parents under 80D.

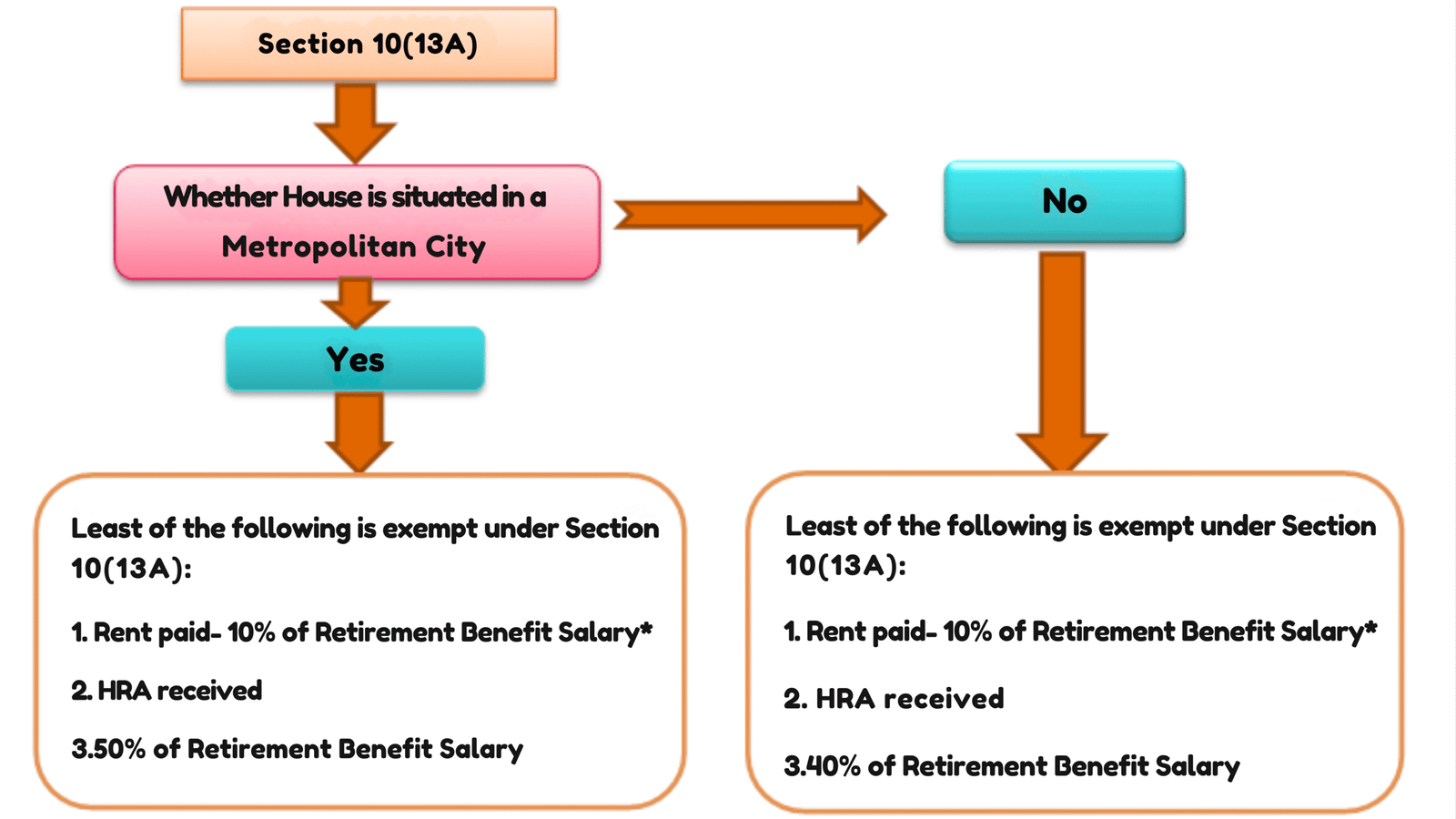

3. HRA – The “I Pay Rent But Still Get Taxed?!” Fix

Best for: Renters (even if you live with family).

How it feels: Like winning a small argument with the taxman.

What No One Tells You:

- You can pay rent to your parents and claim HRA (just transfer money and get a receipt).

- If your rent is ₹1 lakh+/year, share your landlord’s PAN (or they’ll tax you extra).

Tool: generate rent receipts for HRA claims.

4. NPS – The “I’ll Retire One Day (Maybe)” Tax Saver

Best for: People who forget to save for retirement (but want extra tax savings).

How it feels: Like planting a money tree for your future self.

Why It’s Underrated:

- Extra ₹50,000 deduction (above 80C’s ₹1.5L)

- The employer adds more money if you contribute (free cash!).

Learn more about how NPS gives an extra ₹50,000 tax benefit.

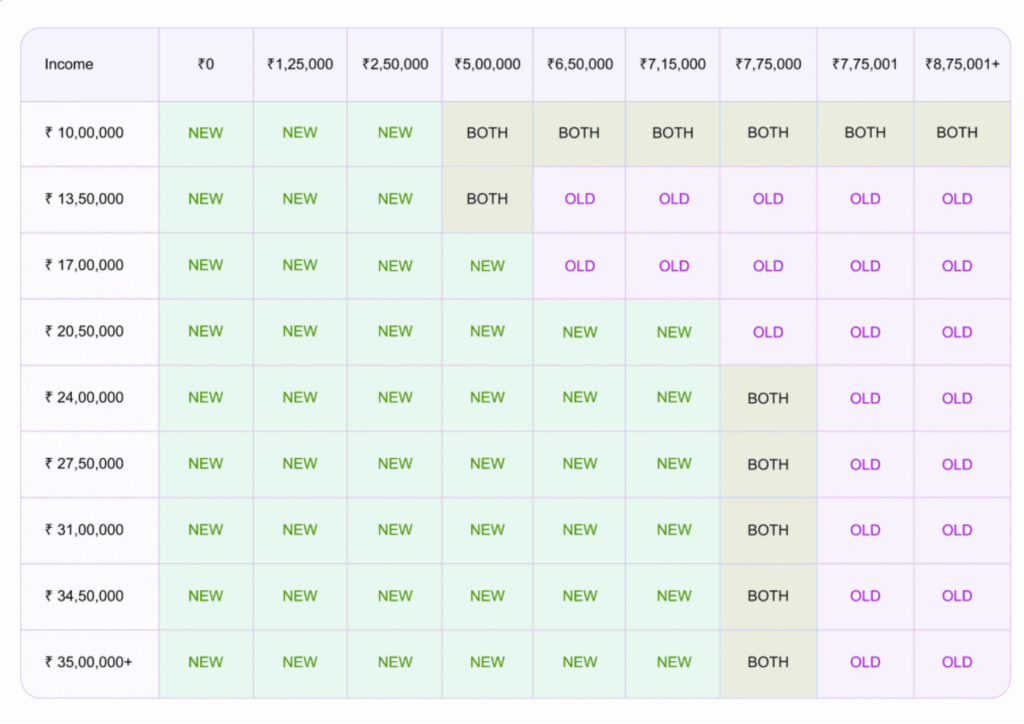

5. New vs. Old Tax Regime – The “Which One Doesn’t Rip Me Off?” Decision

Best for: People who hate math but love saving money.

Simple Rule of Thumb:

- Old Regime: You invest in tax-saving stuff (80C, HRA, etc.) → Pick this.

- New Regime: You don’t invest much → Pick this.

💡Insight: The new regime looks tempting (lower rates), but the old one usually saves more if you use deductions smartly. Check the latest income tax slabs for 2025-26.

3 Emotional Tax Mistakes You’ll Regret (Learn From My Pain)

- “I’ll Do It Later” (Spoiler: You Won’t)

- March 31st tax-saving panic = bad decisions (like locking money in 15-year PPF just to save tax).

- Fix: Start a small SIP in ELSS today (even ₹1,000/month).

- “My HR Will Remind Me” (They Won’t)

- HRA proofs, LTA claims—submit early or lose money.

- Fix: Set a phone reminder for December 1st (before the year-end rush).

- “I Don’t Earn Enough to Save Tax” (Yes, You Do!)

- Even with a ₹6L salary, smart HRA + 80C planning can save ₹15,000+ in taxes.

- Fix: Use a free tax calculator to see exact savings.

FAQs – Real Questions Real People Ask

“How much tax can I ACTUALLY save?”

Example: ₹10L salary + ₹25K rent + ₹1.5L 80C = ₹40,000+ saved.

“Can I save tax without locking money for years?”

Yes! ELSS (3-yr lock-in) > PPF (15-yr lock-in).

“What if I messed up last year?”

You can still file revised returns (within 2 years).