Let’s Talk About Debt (Without the Guilt)

Does it feel like half your salary vanishes into EMIs every month? You’re not alone in this struggle. Over 40% of urban Indians are grappling with “debt management in India”, juggling loans and credit card bills that seem to grow faster than their savings. But here’s the good news: mastering debt management in India isn’t as daunting as it sounds. With the right strategies, you can take control and pave the way to financial freedom.

This guide is like a heart-to-heart with your financially savvy friend—no jargon, no judgment. We’ll walk you through proven debt management in India hacks to help you:

- Slash sky-high interest rates on “credit card debt relief” programs.

- Protect your credit score by avoiding loan defaults with smart “debt consolidation loans”.

- Sleep better knowing your finances are under control with “debt counseling services”.

Ready to break free from the debt cycle? Let’s dive into it and explore strategies tailored for 2025.

What is Debt Management in India? (Your Financial Lifeline)

Debt management in India isn’t about swearing off credit cards or living like a hermit. It’s a strategic plan to regain control over your finances by prioritizing, negotiating, and consolidating your debts. Think of it as organizing a messy closet—once you sort it out, everything feels lighter.

Here’s what managing your debt in India involves:

- Prioritize Debts: Focus on high-interest loans first, like credit cards, using methods like the “debt avalanche method“.

- Negotiate with Lenders: Banks and NBFCs can lower interest rates or extend tenures if you ask, a key part of “credit card debt relief“.

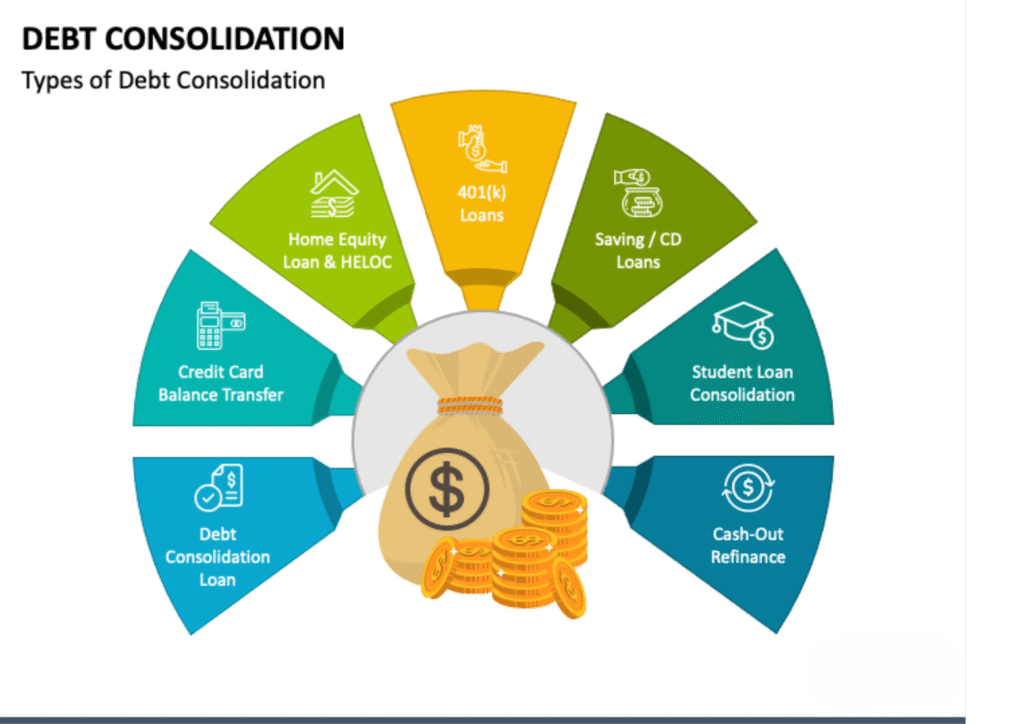

- Consolidate Payments: Merge multiple loans into one affordable EMI with “debt consolidation loans“, reducing stress and interest.

Real Talk: Most Indians wait until debt becomes a crisis before acting. Don’t be that person. Early debt management in India can save you thousands in interest and years of stress.

Whether you’re in Pune, Mumbai, or Delhi, local debt management services in Pune, Mumbai, or Delhi can tailor these strategies to your city’s unique financial challenges, like high rents or informal loans. Let’s explore five debt management in India hacks that work in 2025.

5 Debt Management Hacks That Actually Work in India

1. Debt Consolidation Loans in India: Your Secret Weapon

Are you juggling three or more high-interest loans, like credit cards at 40% or personal loans at 15%? Debt consolidation loans are a game-changer for debt management in India. They combine all your debts into one loan with a lower interest rate, simplifying payments and saving money.

Best for: Anyone with multiple loans struggling to track EMIs.

How it works: Take a single debt consolidation loan from a bank or NBFC to pay off existing debts. Repay this loan at a fixed, lower rate over a comfortable tenure (e.g., 36–60 months).

Top Providers for Debt Consolidation Loans:

- Banks: SBI, HDFC, ICICI offer debt consolidation loans at 10–14% interest.

- NBFCs: Bajaj Finserv, MoneyTap, and RupeeCircle provide flexible debt consolidation loans with online approvals.

- P2P Platforms: Lendbox offers debt consolidation loans for bad credit in major cities.

Pro Tip: Use [BankBazaar] to compare debt consolidation loans and find the lowest rates. Always check for hidden fees like processing charges.

Example: Priya from Mumbai had ₹3 lakh in credit card debt at 42% and a ₹2 lakh personal loan at 15%. She took a debt consolidation loan from HDFC at 12%, reducing her monthly EMI from ₹15,000 to ₹10,000, saving ₹60,000 annually.

By choosing debt consolidation loans, you streamline debt settlement in India and reduce financial stress. Start exploring options today to simplify your repayments.

2. Credit Card Debt Relief in India: Negotiate Like a Pro

Credit card debt is a silent killer, with interest rates as high as 40%. But here’s a secret: banks often agree to credit card debt relief if you negotiate smartly. Managing your debt in India thrives on these negotiations, saving you thousands.

Best for: Loyal credit card users struggling with high interest or late fees.

How to Negotiate Credit Card Debt Relief:

- Call your bank’s customer care and say: “I’ve been a loyal customer for [X years]. Can you lower my 36% interest to 18%? I want to avoid settling this debt elsewhere.”

- Request a hardship plan if you’ve faced job loss or medical emergencies.

- Ask for late fee waivers or extended payment tenures.

Success Rate: Works ~70% of the time, especially with RBI-registered debt management companies assisting. [Settle MyLoan]

Example: Arjun in Delhi owed ₹1.5 lakh on his SBI credit card at 38%. After negotiating, the bank reduced it to 20% and waived ₹10,000 in fees, easing his credit card debt relief journey.

Real Talk: Don’t be shy to negotiate. Banks want you to repay, not default. Credit card debt relief is a cornerstone of debt settlement in India.

For professional help, local debt management services in Pune, Mumbai, Delhi like CreditSudhaar in Delhi can negotiate on your behalf, ensuring credit card debt relief aligns with your debt clearance goals in India

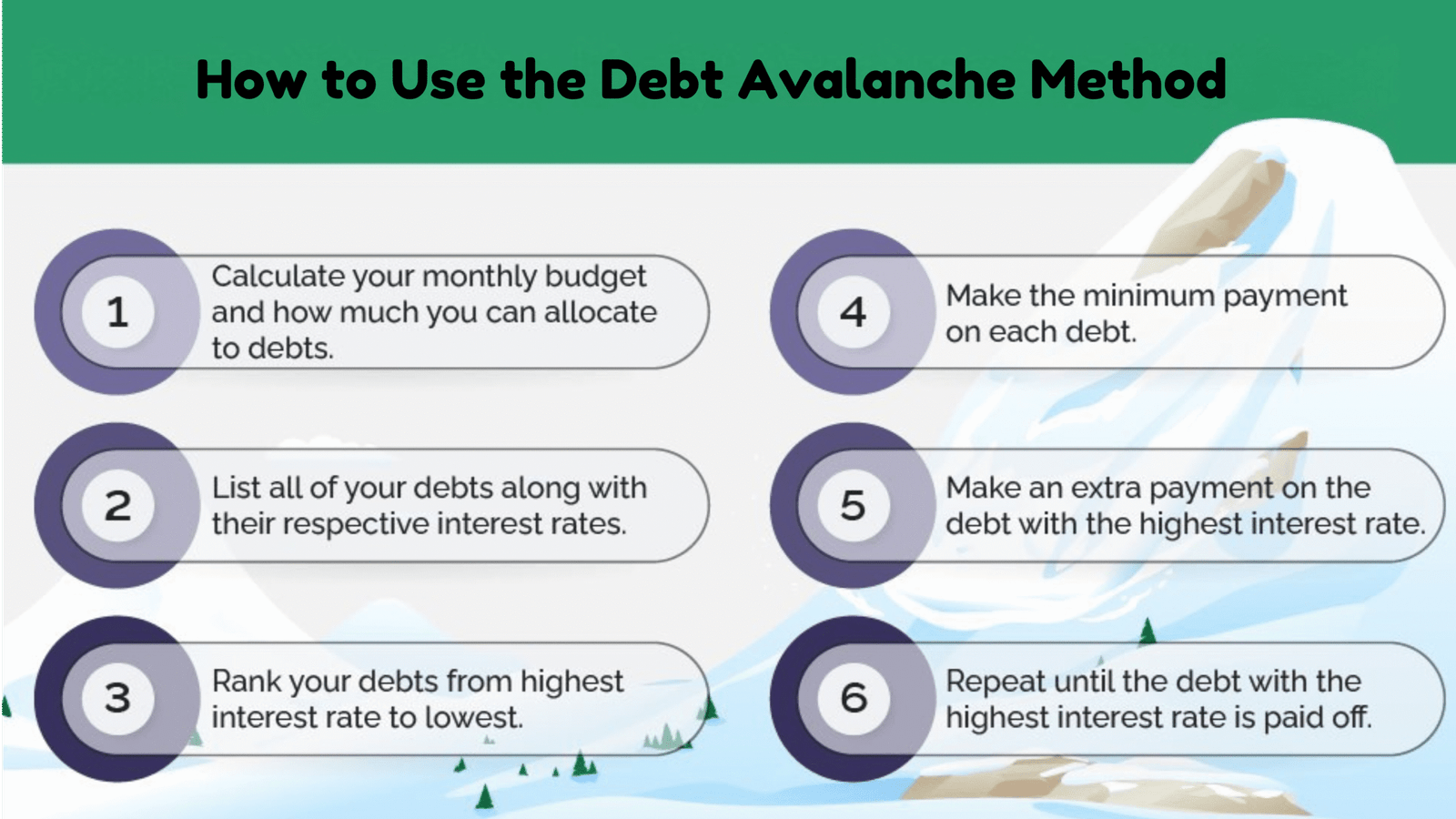

3. The Debt Avalanche Method: Math-Powered Debt Management

If you love numbers, the debt avalanche method is your go-to for debt clearance in India. It’s a logical approach to tackle high-interest debts first, minimizing total interest paid.

Best for: Disciplined individuals with multiple debts.

How the Debt Avalanche Method Works:

- List all debts from highest to lowest interest rate.

- Pay minimums on all debts except the one with the highest rate.

- Throw extra cash at the costliest debt until it’s gone.

- Repeat until all debts are cleared.

Example Debt Avalanche Plan:

| Debt | Interest Rate | Balance |

|---|---|---|

| Credit Card | 42% | ₹2,00,000 |

| Personal Loan | 14% | ₹5,00,000 |

| Car Loan | 8% | ₹3,00,000 |

Attack the credit card first, then the personal loan, and finally the car loan. This saves thousands compared to random payments.

The debt avalanche method is a powerful tool for debt management in India, especially for high-interest credit card debt relief. Try it with our free debt repayment tracker below.

4. Loan Settlement Companies in India: Proceed with Caution

RBI-registered debt management companies like SingleDebt and FREED offer loan settlement, negotiating with creditors to reduce your debt. While tempting, debt clearance in India via settlement has risks.

Best for: Those who’ve exhausted all other debt management strategies and face difficulty.

How Loan Settlement Works:

- You save monthly in a special account managed by the company.

- Once enough funds accumulate, they negotiate a reduced payoff (e.g., 50% of the original debt).

- You pay the settled amount, and the debt is closed.

Risks:

- Settlements can lower your credit score for 2–3 years.

- Unregulated companies may charge upfront fees or fail to deliver.

Top RBI-Registered Debt Management Companies:

- SingleDebt: Offers transparent debt settlements in India with anti-harassment services.

- FREED: Specializes in credit card debt relief and debt consolidation loans.

- Loansettlement.com: Focuses on personal loan and credit card settlements.

Red Flags: Avoid companies promising “100% debt erasure” or charging high upfront fees. Always verify RBI registration via [RBI’s NBFC List].

Real Talk: Loan settlement is a last resort for debt management in India. Try debt consolidation loans or debt counseling services first.

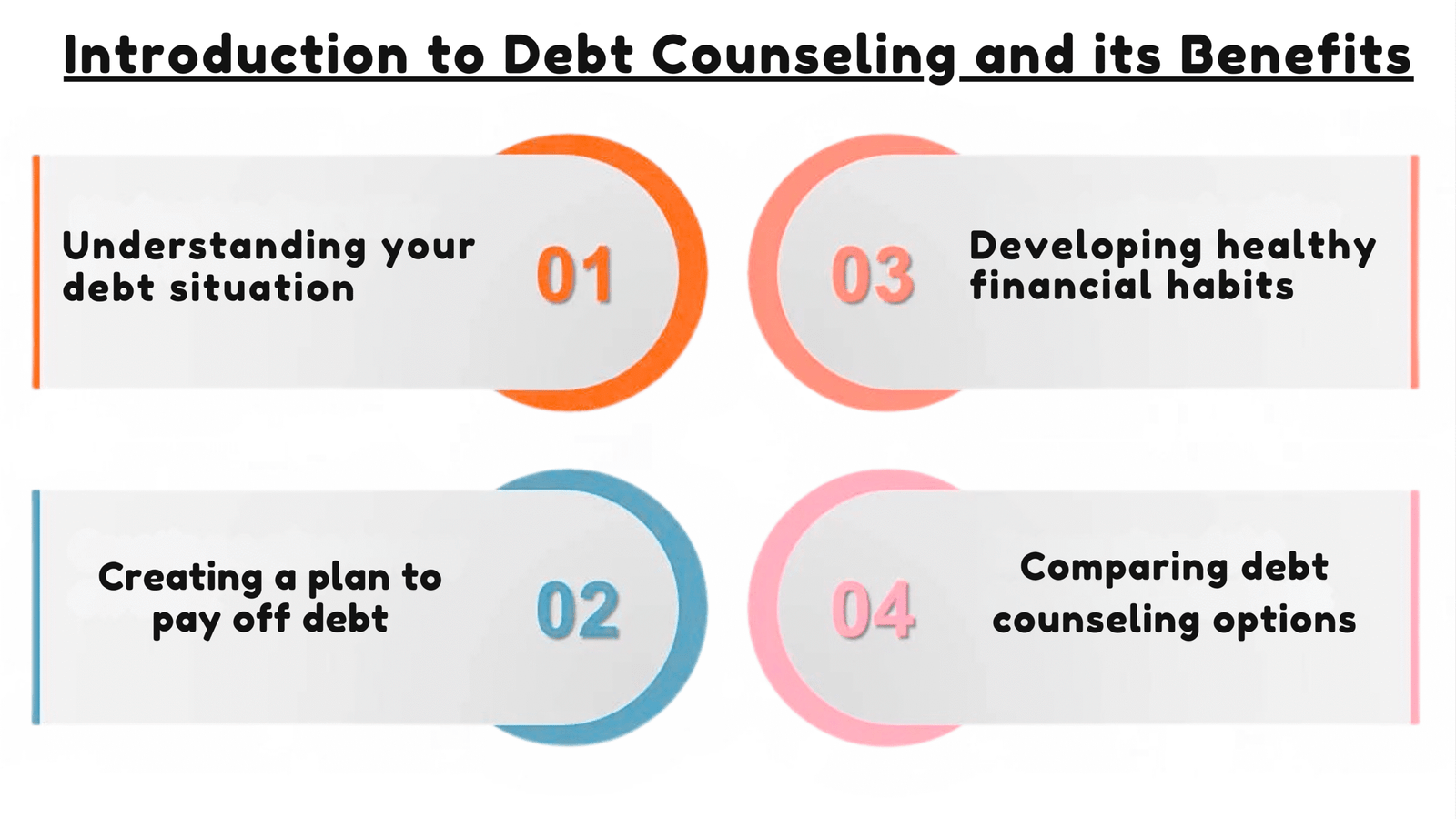

5. Debt Counseling Services in India: Free or Low-Cost Help

Debt counseling services are a lifeline for debt management in India, offering expert advice without breaking the bank. Non-profits like Disha Financial Counseling provide free or low-cost debt management strategies.

Best for: Anyone overwhelmed by debt needing a personalized plan.

What to Expect from Debt Counseling Services:

- A counselor reviews your income, expenses, and debts.

- They create a tailored debt management in India roadmap, often including debt consolidation loans or credit card debt relief.

- They negotiate with creditors to lower rates or extend tenures.

Top Debt Counseling Services:

- Disha Financial Counseling: Free debt counseling services backed by ICICI Bank.

- Rectifycredit.com: Mumbai-based, helps with credit card debt relief and credit score repair.

- CreditVidya: Offers online debt counseling services for young borrowers.

Cost: Free to ₹2,000/month, depending on the service. Avoid agencies charging ₹10,000+ upfront.

Debt counseling services are a cornerstone of debt management in India, especially for those in Pune, Mumbai, or Delhi seeking local debt management services Pune Mumbai Delhi.

The Dark Side of Debt Management in India: Avoid These Mistakes

Even the best debt management in India plans can fail if you make these common mistakes. Here’s what to watch out for:

- Ignoring Small Debts: A ₹10,000 medical loan at 12% can grow to ₹17,000 in 5 years. Tackle small debts early using the debt avalanche method.

- Taking New Loans to Repay Old Ones: Unless it’s a debt consolidation loan, this creates a deeper debt trap.

- Trusting “Quick Fix” Schemes: Promises like “Pay ₹5,000 to erase ₹5 lakh debt” are scams. Stick to RBI-registered debt management companies.

Example: Sneha in Pune ignored a ₹20,000 credit card bill, thinking it was minor. Two years later, it ballooned to ₹35,000 with interest and fees, derailing her debt management in India plan.

Avoid these pitfalls to ensure your debt management in India strategy succeeds, whether you’re using debt consolidation loans, credit card debt relief, or debt counseling services.

Local Solutions: Debt Management Services in Pune, Mumbai, Delhi

Local debt management services Pune Mumbai Delhi offer tailored debt management in India solutions, understanding regional challenges like high rents or informal loans. Here’s why local expertise matters:

- Mumbai: High living costs mean many struggle with credit card debt relief. Local agencies like MoneyMantra negotiate with banks to ease EMIs.

- Delhi: Informal loans from local lenders complicate debt management in India. CreditSudhaar helps formalize repayment plans.

- Pune: Young professionals often face credit card debt. Financial Planning Experts India offers debt counseling services for affordable plans.

Top Local Debt Management Services:

- Pune: Financial Planning Experts India – Specializes in debt consolidation loans and debt counseling services.

- Mumbai: MoneyMantra – Experts in credit card debt relief and creditor negotiations.

- Delhi: CreditSudhaar – Offers debt clearance in India with credit score repair.

FAQs: Real Questions from Indians Like You

Got questions about debt management in India? Here are answers to common concerns:

Can I negotiate credit card debt myself?

Yes! Call your bank’s customer care and politely request a lower interest rate or hardship plan for credit card debt relief. Be honest about your financial situation.

Will debt settlement hurt my credit score?

Yes, temporarily, for 2–3 years. But rebuilding with debt counseling services is better than drowning in debt forever.

How much does debt counseling cost?

Free to ₹2,000/month with reputable debt counseling services like Disha. Avoid agencies charging ₹10,000+ upfront.

Are debt consolidation loans safe?

Yes, if from RBI-registered debt management companies or banks like SBI. Compare rates on [Bank Bazaar] to avoid high fees.

Most relevant and informative article.